Articles

- Details

- Category: Training

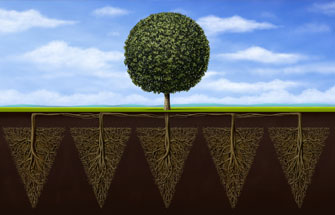

The principal challenge for Private Equity (PE) investors wanting to augment their portfolio with Innovation investments is to find the “golden nugget” early enough to enjoy a multiple return commensurate to risk. Traditionally, PE investors are categorized as “pre-revenue” and “post-revenue”; pre-revenue being family and friends for very early stage and angel investors following, and post revenue investors being Venture A and B funds. Within these, there exists a further delineation, however for purposes of this article, the above will suffice.

The principal challenge for Private Equity (PE) investors wanting to augment their portfolio with Innovation investments is to find the “golden nugget” early enough to enjoy a multiple return commensurate to risk. Traditionally, PE investors are categorized as “pre-revenue” and “post-revenue”; pre-revenue being family and friends for very early stage and angel investors following, and post revenue investors being Venture A and B funds. Within these, there exists a further delineation, however for purposes of this article, the above will suffice.

- Details

- Category: Living in Monaco

As manager of the mandatory social security scheme, Caisses Sociales de Monaco has a major responsibility for Monaco’s employees, pensioners, self employed and their households. Meet Bertrand Crovetto, Deputy Director of Caisses Sociales de Monaco, to understand current CCSS issues better.

As manager of the mandatory social security scheme, Caisses Sociales de Monaco has a major responsibility for Monaco’s employees, pensioners, self employed and their households. Meet Bertrand Crovetto, Deputy Director of Caisses Sociales de Monaco, to understand current CCSS issues better.

- Details

- Category: Other Topics

Matthieu Letort is Managing Director and Founding Partner of Prometheus Wealth Management, recently established in Monaco. Meet him.

- Details

- Category: Living in Monaco

The employers' representatives of the Principality have just signed the Charter for the Equality of women and men at work proposed by the Department of Social Affairs and Health, in relation to all stakeholders and the Committee for the Promotion and Protection of Women’s rights.

The employers' representatives of the Principality have just signed the Charter for the Equality of women and men at work proposed by the Department of Social Affairs and Health, in relation to all stakeholders and the Committee for the Promotion and Protection of Women’s rights.

- Details

- Category: Legal Environment

On October 2nd, Mr Hunault met the actors of the Monegasque Finance at a luncheon organized by AMAF (Monegasque Association of Financial Activities).

On October 2nd, Mr Hunault met the actors of the Monegasque Finance at a luncheon organized by AMAF (Monegasque Association of Financial Activities).

- Details

- Category: Products and Services

In a low interest rate environment, the stress experienced in the markets is evident. Two years ago, GFG (Groupe Financier de Gestion) Monaco started launching Alternative Alpha Strategy, a selection technique for liquid alternative investment funds developed in-house by GFG Lab, GFG’s quantitative division.

- Details

- Category: Training

On Wednesday, Minister of State Serge Telle, in the presence of the relevant authorities, received staff members who had passed the Monegasque Professional Certification introduced by the Prince’s Government at the initiative of the Monaco Association for Financial Activities (AMAF).

On Wednesday, Minister of State Serge Telle, in the presence of the relevant authorities, received staff members who had passed the Monegasque Professional Certification introduced by the Prince’s Government at the initiative of the Monaco Association for Financial Activities (AMAF).

- Details

- Category: Products and Services

According to the results of the fourth barometer published by the Association Française du Family Office (AFFO), private equity makes up 21% of allocations. Assets under management in private market funds had reached $4 billion and $2.5 billion in private equity at the end of 2017. In the face of this strong demand, significant challenges are now emerging that fintechs need to address in order to support the development of private equity.

- Details

- Category: Training

On Friday 13 September, in partnership with the Ascoma Group, the Monaco Economic Board hosted Jean-Pierre Petit, President of the Cahiers Verts de l'Économie, for a conference on the theme of 2020 risks. A fascinating decryption for more than 150 entrepreneurs.

On Friday 13 September, in partnership with the Ascoma Group, the Monaco Economic Board hosted Jean-Pierre Petit, President of the Cahiers Verts de l'Économie, for a conference on the theme of 2020 risks. A fascinating decryption for more than 150 entrepreneurs.

- Details

- Category: Other Topics

Having arrived in Monaco only a few months ago to head Banque Populaire Méditerranée, he considers himself a "demanding humanist" but with great modesty. Monaco’s multicultural environment doesn’t displease this man who "always takes an interest in others".

- Details

- Category: Interviews

A few months ago Sérène El Masri became the Site Manager of the Monaco branch of Union Bancaire Privée (UBP), a bank she joined in 2017 in Geneva as head of its private banking activities for Monaco, Luxembourg and the French-speaking regions. This bold banker shared her first impressions of the Monaco market with us.

A few months ago Sérène El Masri became the Site Manager of the Monaco branch of Union Bancaire Privée (UBP), a bank she joined in 2017 in Geneva as head of its private banking activities for Monaco, Luxembourg and the French-speaking regions. This bold banker shared her first impressions of the Monaco market with us.

- Details

- Category: Products and Services

Impact investing and mainstream private equity have joined forces. An ambitious UBS Global Wealth Management plan created three years ago has attracted two-and-a-half billion Swiss francs of investment that seeks to generate market rates of return and a measurable, verifiable, positive impact on people and planet.

- Details

- Category: Legal Environment

Private equity and the development of this activity in Monaco is a popular topic. How can we define this activity?

- Details

- Category: Other Topics

The Founding President of TC Stratégie Financière SAM established three years ago, Thierry Crovetto is also Professor of Finance at the University of Monaco (IUM, Inseec Group). This finance lecturer and professional moves from theory to practice through his rapidly evolving management company.

- Details

- Category: Products and Services

Voltylab is a young independent SAM: it launched in 2015, with the ambition of bringing added value in the international market for structured products. Deputy chairman Filippo Colombo and managing director Bruno Frateschi agree on the values that motivate them and define their company: Honesty, Transparency, Serenity.

- Details

- Category: Legal Environment

On 29 April 2019, in the presence of Minister of Finance and Economy Jean Castellini, Rupert Schaefer, Head of Strategic Services and member of the Executive Board of the Swiss Financial Market Supervisory Authority (FINMA), and Philippe Boisbouvier, Acting Director of Monaco’s Service d’Information et de Contrôle sur les Circuits Financiers (SICCFIN), signed a reciprocal memorandum of understanding designed to facilitate cooperation between the two authorities in their respective efforts to combat money laundering and terrorist financing.