Ensuring compliance with regulations, but also promoting the attractiveness and high quality of the financial market: these are the goals of the Commission.

The missions of the CCAF

As an independent authority, the Commission possesses powers of decision, verification and sanction: it examines requests for certification by companies and funds and issues approvals;

- it supervises the operations carried out by certified establishments to ensure conformity and performs checks to put an end, if necessary, to irregularities;

- it examines claims that come within its jurisdiction;

- it imposes administrative sanctions;

- it concludes cooperation agreements with its foreign counterparts.

The Commission is composed of nine members, under the Presidency of Christian de Boissieu.

Setting up a business in the Principality

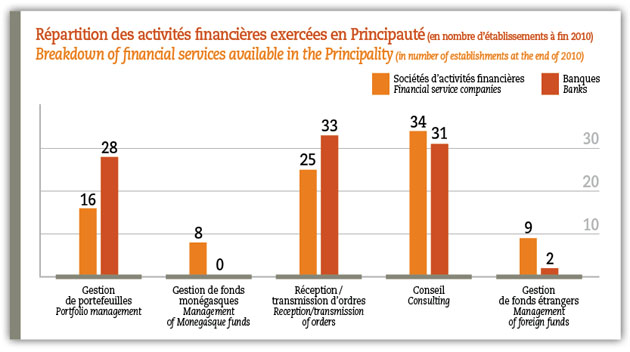

A wide range of financial activities is possible in Monaco: portfolio management on behalf of third parties, of course, but also management of funds established under Monegasque or foreign law, reception/transmission of orders, and consultancy and assistance in management or the reception/transmission of orders. Anyone wishing to carry on one or more financial activities in Monaco must first obtain approval from the commission responsible for the activities concerned, and an administrative authorization to establish in the Principality issued by the Monegasque government. For credit establishments, the approval of the French Prudential Authority is also required. Before making a formal application for certification, project sponsors are invited to contact the General Secretariat of the CCAF so as to present the activities they intend to perform in the Principality.

2010 results and future prospects

Four new certifications and three extensions to already-approved companies were issued in 2010, essentially for consultancy, reception/transmission of orders and management of foreign funds. At the end of the year there were 43 certified financial activity companies, 33 credit establishments and some sixty Monegasque funds. On the international level, the year was noteworthy for the signature of a cooperation agreement with the Dutch regulator, AFM, at the beginning of 2011, bringing the number of international agreements signed to six. The President and Secretary General of CCAF also took part in the annual meeting of the French-language Institute of Financial Regulation held in Brussels.

On account of the financial crisis of recent years, the training and professionalism of people working in the financial market are subjects to which the Commission devotes close attention. One development that is being considered, in partnership with the Monaco Bankers Association (AMAF), is the creation of a professional qualification which would be essential for anyone involved in tasks linked to the markets or dealing with clients in a financial establishment.