At the instigation of H.S.H. Prince Albert II, the Government of the Principality has launched an ambitious policy of international cooperation for development, with the fight against poverty as its main aim.

Since 2008, Public Aid for Development (PAD) has been increasing by 25% per year to reach the goal fixed by the United Nations of 0.7% of GNR by 2015 at the latest. In 2010 Monaco’s PAD will amount to €10 million shared between a hundred or so projects in 24 partner countries, mainly LDCs (Least Developed Countries).

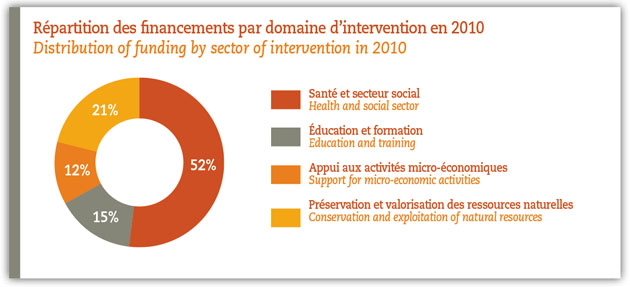

The International Cooperation Department, responsible for the implementation of this cooperation policy for development, is involved mainly in four different sectors corresponding to the Millennium Development Goals (MDG).

Monaco’s support program

Support for micro-economic activities, and particularly microfinance, has been a rapidly expanding sector of activity since the creation in 2008 of the Monegasque Support Program for Micro Finance. The amounts devoted to this fund rose from €250,000 in 2008 to €410,000 in 2010.

The program is designed to help African Micro Finance Institutions (MFI) that serve populations below the extreme poverty threshold. The loans granted represent a few hundred euros per beneficiary. They enable micro-entrepreneurs to launch and develop profitable economic activities so as to escape from the poverty trap. The aim is that MFIs should become profitable in order to be eligible for financing provided by other funding establishments in the form of credit.

Burundi - Improving the economic situation of families caring for orphans and vulnerable children

For the last 3 years, the Government of the Principality, AMADE Mondiale and Fight Aids Monaco have been supporting AMADE Burundi in caring for 37,000 orphans and vulnerable children. Now the aim is to improve the economic situation of the foster families through the “Dukuze” Micro Finance program which will be launched at the end of 2010.

AMADE Burundi has already processed 554 files covering the needs of 28,000 people. The average loan requested is 200 euros. 8,000 potential clients have been identified, and according to figures put forward by the NGO Planet Finance on the basis of a preliminary study financed by Monegasque cooperation, 92% of the population would like to obtain credit of this sort.

South Africa - Access to decent housing for 12,000 households

In 2008, Monegasque cooperation signed a three-year partnership agreement with the association Planet Finance with the aim of supporting the expansion of a Micro Finance Institution (MFI), The Kuyasa Fund, established in the Western Cape Province.

In particular, this MFI offers a micro-credit product designed to improve housing conditions for beneficiaries living in the poorest townships. Kuyasa Fund has extended its activities to two other provinces, while at the same time developing its internal structures and management capability.

12,000 households (60,000 beneficiaries) can thus increase their revenues and obtain better housing.