The start-up financing journey exists in a complex ecosystem, one which involves numerous and sometimes very different players, which often lack any connection.

While financing alone is not enough to guarantee the overall success of a start-up, it is a vital ingredient.

All start-ups have a project that must find a market by offering a product or service that did not previously exist, at least not it the same form. The main challenge facing innovation entrepreneurs is therefore convincing their environment, including investors, that their offer is justified.

In terms of financing, there are a wide range of solutions and approaches, making the task complicated for entrepreneurs and sometimes leading them to focus their energy of the search for financing rather than project development. Support in the form of proven advice can help them avoid the pitfall of wasting time on a time-intensive quest which risks adulterating their project in the name of meeting the criteria for acceptance by certain financing organisations.

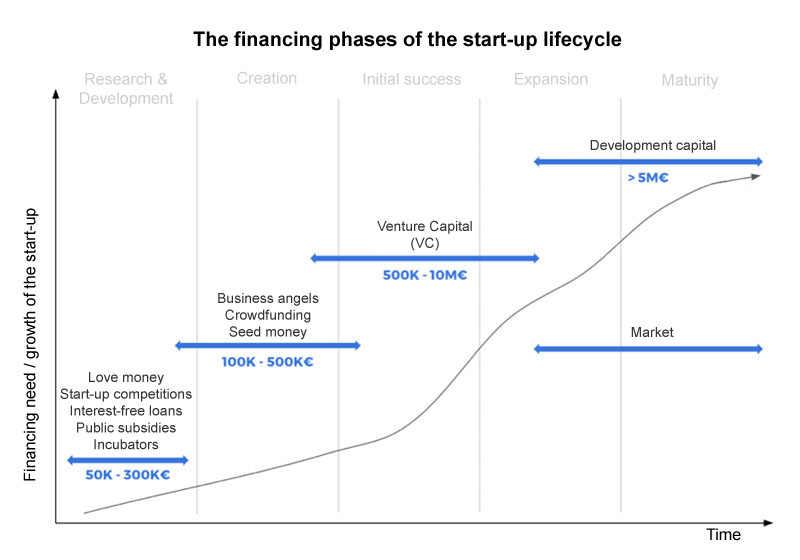

They also need to be able to optimise their search by carefully selecting the financial players to potentially involve, based on the amount of financing needed and the development phase they have reached.

There are three major phases

- Seed: no sales, so no profits,

- Risk: sales, but profits,

- Development: sales and profits.

Different finance players correspond to each of these three phases, and can also be divided into three major groups:

- Public or semi-public institutions: advances which must be repaid or subsidies (e.g. those granted by the Business Development Agency),

- Private players: love money, business angels, crowdfunding and/or crowdlending, investment funds,

- Lending institutions (here, we distinguish between private institutions and banks, since banks offer entrepreneurs non-dilutive solutions).

Public financing

Generally the funds obtained from public institutions are subsidies (which may or may not require repayment) and advances, which are essentially loans with deferred capital and/or interest amortization periods. In Monaco, these funds are managed by the Business Development Agency. They can, where relevant, be completed by a direct intervention in the form of share purchases (SACDE) or a guarantee fund to back bank loans. These measures are generally paired with tax relief measures (tax or social contribution reductions or exemptions).

Private financing

This form of financing is highly diverse and generally quickly completes the founders’ initial capital investment. Love money, sometimes ironically referred to as the “3 Fs” (Family, Friends and Fools) may contributed as soon as the company is created. Players like business angels, investment funds which specialise in seed capital, followed by venture capital funds and then, once profitability is achieved, development capital funds, can then buy into the company, with a more or less significant premium over par, which has a direct impact on the level of dilution for the founders.

Start-ups can also use new forms of fundraising like crowdfunding (which is dilutive), crowdlending (non-dilutive), or launching their own ICO, which may or may not be dilutive depending on the type of ICO used. Monaco has a platform which offers all of these options.

Bank financing

Banks were historically not natural partners for start-ups, because their application analysis system used the company’s history and the existence of revenue (traditionally the last three annual balance sheets) to verify its ability to repay a loan. A start-up in the early phases, however, has more of a future than a past.

To avoid losing these customers, banks have therefore changed the way they analyse their applications.

- Given these companies’ lack of history, banks focus on their outlook rather than traditional ratios, which are generally non-existent.

- Because they are often unfamiliar with the technologies developed by these companies, they tend to rely on institutions which have already approved the project: incubators, “innovation” certification, and public subsidies.

- Faced with recurrent issues such as low equity, inadequate tangible assets, and entrepreneurs who have often sunk all their own resources into developing their project, banks look to counter guarantees, like those offered by the Monegasque Credit Guarantee Fund.

- Finally, since projects often do not generate revenue during their early days, the financing granted includes a grace period of up to two years.

Bank financing is generally granted in the risk and development phases.

However, banks which are open to start-ups often have a team of specialist advisers who are used to working with and advising entrepreneurs. They therefore have a significant role to play during all three phases, and can help build Monaco’s economic future.