The strong growth in Responsible Investment and Sustainable Development in recent years comes in response to investors rising to meet the challenge of the future. The Criteria Environmental, Social and Governance (ESG) are the pillars of ethical investment. At the Compagnie Monégasque de Banque (CMB), this reality has been a part of our work for a long time.

In 2006, in partnership with the government, we created a dedicated Environmental fund: Monaco Eco+. Today, we are going a step further by increasing the extent to which we incorporate non-financial ESG investment criteria into our investment vehicle selection process.

We still select our portfolio assets on the basis of traditional financial criteria, but that process now also includes an assessment of ESG criteria. Starting this year, in addition to this across-the-board approach, we are also offering a specific ESG mandate for the most demanding investors.

This approach uses Sustainability- and Responsibility-related objectives for investment decisions, with the addition of specific criteria. It aims to reconcile economic performance and Social and Environmental impact.

Against this backdrop, the CMB wants to offer its customers a way to contribute to financing the companies and public entities that make the most outstanding contributions to Sustainable Development, regardless of their industry. And to influence Governance and stakeholders’ behaviour, which can foster a more responsible economy.

How are investment selections assessed?

Issuers are rated by analysts and specialised, recognized and published ratings agencies. Their work incorporates Environmental criteria related to direct or indirect environmental impact, as well as Social criteria such as respect for human rights and international labour standards compliance. Finally, the Governance aspect focuses on the issuers’ leadership, administration, and control practices.

While the issuers are independently rated, this assessment is not, on its own, a guarantee of the assets’ economic and market performance. Financial expertise continues to provide a response to investors’ legitimate expectations in terms of returns.

To that end, the CMB uses a proprietary systematic assessment process based on data provided by independent ratings agencies. It aims to provide a more detailed assessment of the risk data. The ESG approach includes valuation analysis and makes it possible to select companies with “best in class” behaviour. This approach enables us to maintain a positive attitude, focused on selecting companies that are capable of developing a competitive edge thanks to their ESG best practices. Furthermore, the broad investment environment created by this proprietary assessment method allows a high degree of flexibility in selecting investments.

We are focused on appropriating our investments rather than applying an outdated exclusionary approach.

What about performance?

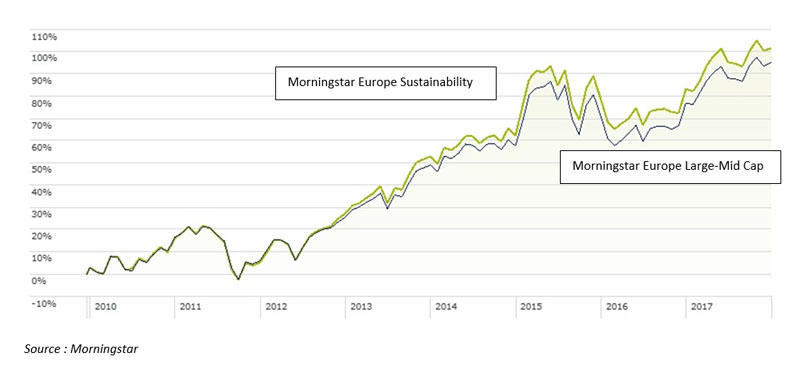

The theme’s performance confirms the trends observed for the funds. Morningstar’s performance analysis indicates that the companies favoured by sustainable indices tend to be in better financial health, hold a better competitive position, and be less volatile.

This analysis also supports the theory that companies which are attentive to ESG criteria are acting in their own interests. Using less energy helps control costs. Treating employees well helps attract and retain talents. An independent Board of Directors provides better control of decisions.

Rather than hurting share performance, ESG management has proven that it contributes both to developing sustainable economic activities and delivering higher financial yields.