Law 1339 of 7th September 2007 broadened the range of fund asset types, making it possible to hold non-financial assets. It was a major development.

These new rules offer an up to date framework that allows the development of new types of fund, using alternative patterns of management or private equity. Their flexibility is derived from the possibility of exemption from rules applied to the spread of financial and/or non-financial assets, and so creating funds that are totally exempt.

Clearly, the legislator has linked this flexibility with strict rules for the protection of savings by ensuring that such products are only offered to properly informed or professional customers.

New products

Furthermore, the creation of new products implies an enhanced role for internal monitors and external auditors, such as commissaires aux comptes (statutory auditors). They have broad responsibilities that require the application of the best practices and compliance with international standards.

Quick and simple

The authorisation process for a Monaco Fund is quick and simple. The entire stake rests on the abilities of the proposers to bring together guarantors of unimpeachable quality, thereby giving credibility to the strategy presented in the prospectus:

- Recourse to acknowledged and appropriate expertises,

- Evaluators applying the best practices and ensuring the absence of any conflict of interest,

- Depositary with protection and conservation guarantees for the assets (insurance, storage, etc.)

- Internationally recognised auditors with the ability to analyse procedures and internal monitoring mechanisms.

This is a niche to explore for the development of Monaco’s market, with its natural and historical inclination towards this sort of asset (luxury, art, real estate, etc.), which is well suited to the highly specialised local clientele.

The art investment fund as example

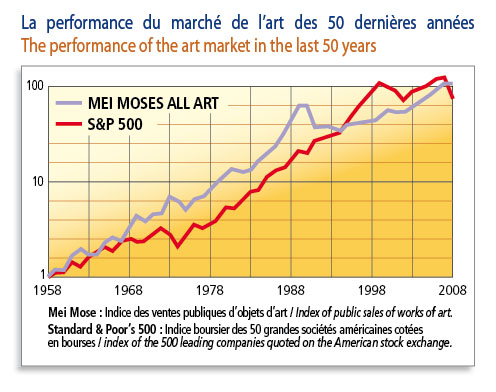

Far from upsetting all trends, the current crisis has brought a new boost to the growing interest shown in real, directly owned assets, which are not linked to financial markets. Amongst these “safe assets”, art is particularly favoured, principally from the Impressionist and Modern periods.

Art is a “passion-driven investment”, bringing emotion back into the world of finance, and it has become synonymous with performance. Tangibility and intrinsic value of a work of art, limited links to other sorts of asset and reduced exposure to crises: these advantages make it an alternative investment of choice.

This has led to growing numbers of this type of dedicated fund, with 50 created since 2004, mostly in India and China. Some have appeared in Europe too, while others, like Trezart, are being established to exploit the opportunities offered by the crisis. Their clients are wealthy private investors as well as Family Offices and institutions that are concerned to diversify their portfolios.

The key elements of a successful art investment fund?

- Spreading the risk with a diverse portfolio of works.

- Internal management and expertise, bringing together professionals from art and financial markets.

- A wide network of direct and permanent contacts with the key players of the market.

- Direct transactions that optimise performance.

- A closed fund structure, which gives investors a clear view of the exit.

- Very high quality standards for the works of art and exemplary risk control (authenticity, origins, etc.).

- A simple and well-regulated model, favouring transparency and ease of monitoring.

- An art investment fund is both a high-yield instrument for investment diversification, but also an opportunity to make a passion-driven investment in a regulated environment.