Filippo Colombo, Deputy Chairman, and Bruno Frateschi, Managing Director, are the two founders of VOLTYLAB “Investments & Partnership”. Working with a limited number of partners, with total honesty, independence, and transparency is their company’s aim.

When was Voltylab created?

The start of our operation dates back to the final quarter of 2015, when we initiated the C.C.A.F (Financial Activities Control Commission) accreditation process at the beginning of the year. Strictly speaking, we are not a management company. We have the right to place orders, but our job is rather to act as an intermediary between professional clients, asset managers and structured product providers. For our clients we make a summary of the international structured products market, since the providers are many and located all over the world: in France, Switzerland, Germany, Austria, Luxembourg, the UK. Large banks such as Société Générale, Morgan Stanley, Goldman Sachs etc. have marketed this type of product for a very long time.

We are two former Commerzbank Corporates & Market employees. We met in London in the early 2000s. Some of our clients wanted to expand in Monaco and we helped them. They have stayed with us since then. They have been partners for nearly fifteen years. We work with a limited circle of partners who understand our added value: where appropriate, we defend their interests against large financial institutions. We place our know-how at their disposal (you need to be very familiar with structured products so as not to be surprised) and our volumes guarantee a certain strike force.

What do you mean?

Asset managers outsource their services to get skills and guarantees. When an asset manager requests a product from a counterparty, we get them much more attractive conditions. To date, we have handled a minimum of two structured products per working day, i.e. approximately five hundred per year, with a volume in excess of 500 million euro.

What is your added value?

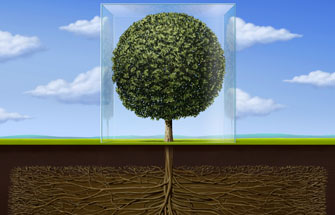

We detest lack of transparency. To safeguard clients’ interests, we created a software support, Voltyfeed, enabling full support over the life of a product so that control of it is never lost. It is a database that manages performance and product types (products are structured by risk profile), and allows the client to manage all risks throughout a structured product’s lifespan. This is our day-to-day added value, that saves asset managers’ time and allows them to explain the market to their clients in a simple, systematic way.

Ten years ago, the structured products market was scorned. But they are very interesting products that can make money for clients, providing they build them and monitor them meticulously. We always view the possible result from the end client’s point of view. We only recommend what we believe is right for them, not for the intermediaries. It is their capital that clients put at stake, and we have chosen to protect it, in the long term.