In the era of digital transformation, supported by these two years of health crisis, Regulatory Compliance is being offered an unprecedented opportunity to become digital and thus an active player in the technological developments and innovations applicable to its functions. This is an essential turning point for the Principality and for all the institutions subject to the law.

Indeed, digitalisation has already enabled the transformation of the majority of commercial, HR and accounting processes and training channels (CRM, ERP, HRIS, etc.). The cost of compliance is still very high, mainly because of the very high proportion of manual tasks.

Thus, although the direct advantages of digitalising the Compliance function may seem obvious, around 80% of those subject to the LABFTC do not yet have suitable IT tools in the Principality. Among these advantages, we can list:

-

More efficient and less costly daily management

-

Elimination of repetitive tasks with little added value

-

Increase in the quality of data and the level of formalisation of due diligence

-

A significant improvement in the customer experience

Examples of short-term solutions?

Today, local RegTechs, such as Equilateral.io, are developing "all-in-one" solutions to help regulated professionals optimise and ensure their compliance function. From tomorrow, an estate agent or any other regulated professional will be able to access an online portal where he or she will be able to see at a glance the level of compliance of his or her establishment and that of his or her clients.

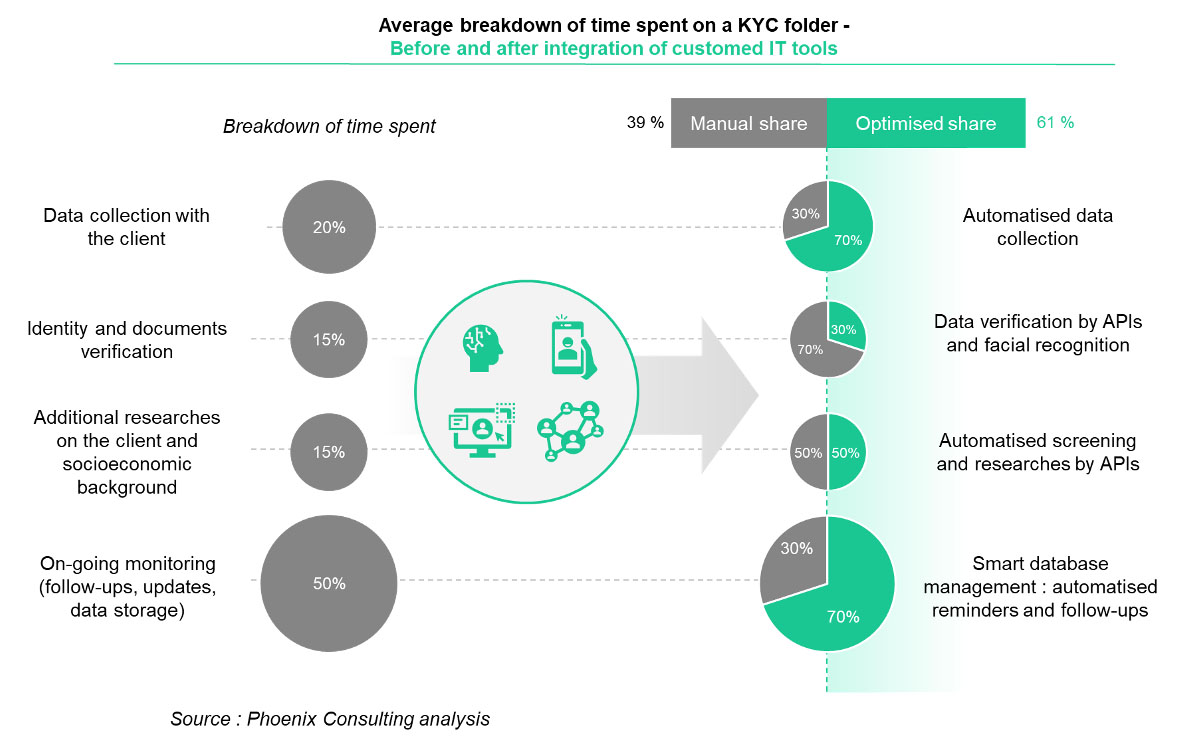

By automating administrative tasks such as: automatic document collection, identity verification by facial recognition, verification of documents by AI, automatic screening by API, management of reminders or automatic data retention, the regulated professional will be able to concentrate more on tasks with higher added value.

Another concrete example in the Principality is the creation of an Economic Interest Grouping (EIG), called MONAFILE, whose main objective is to pool the collection of KYC documents from the clients of regulated professionals, in the name and on behalf of the latter. This project, initiated by several Associations, Chambers and Orders in the Principality, responds to the following observation: today, the same client is obliged to provide the same documents and information each time he wishes or needs to enter into a relationship with a professional subject to the LABFTC. In the same way, these professionals will all have to carry out the same diligence in order to collect and verify this information.

Conclusion

Although the cost of regulatory compliance continues to evolve for regulated professionals, the combination of the various solutions offered by a growing ecosystem should enable them, in the near future, to benefit from quality compliance at a lower cost.

Moreover, the transformation of the Compliance function is part of a wider project and does not rely solely on the installation of innovative IT software. Indeed, it requires reflection, upstream, on the implementation of a new governance and transversal operational processes between the various professions (Compliance, Front Office, etc.). It is these latter levers that will enable institutions to ensure the effectiveness of their processes in a sustainable manner.

The digitalisation of the Compliance function will grow exponentially over the next few years, especially with the large-scale deployment of AI, combining Blockchain and Machine Learning. The next challenges for the Principality will be to increase its data storage capacity while ensuring that it is effectively secured for all. "The era is now one of digitalisation of the Compliance function".

1 - Lutte Anti Blanchiment de Capitaux, Financement du Terrorisme et Corruption

2 - Intelligence Artificielle

3 - Application Programming Interface