GFG Monaco SAM is part of the GFG Group, founded in 2010, with its headquarters in Monaco and offices in Lausanne and Milan. The group provides financial services to both institutions and private individuals. The Group consists of a team of finance professionals with extensive, multi-asset experience at international investment banks. Investment managers are supported by senior analysts with quantitative and research-focused backgrounds.

The Quantitative Fund Industry is one of the most innovative and fast growing, approaching $1tn of Assets under Management in 2018, following the recent growth of more systematic, computer-powered investment strategies. Nowadays quant funds offer a very wide range of strategies, including factor investing, risk parity, managed futures and several “black-box” engines, which do not disclose any information of the algorithm logics or structure.

How does GFG approach such innovative market?

Over a number of years, GFG has been developing a proprietary and innovative Asset Allocation model able to satisfy different needs in terms of Risk exposure, conjugating the classical, qualitative active asset management with the latest innovative quantitative and mathematical techniques. This model is extremely scalable in terms of risk and assets exposure, investing in a diversified range of UCITS funds with daily liquidity.

To design, develop and maintain such a model, named AAA – ACTIVE ASSET ALLOCATION, GFG Monaco launched GFG LAB in 2015, its quantitative and research division with a solid mathematical and engineering background. This strategy has been implemented on three Cayman vehicles since 2016 and will be soon launched under the UCITS format.

AAA model elaborates the drawbacks of purely quantitative approaches, building on an innovative, quantitative and systematic mould, creating a scalable and fully transparent extensive Asset Allocation investing in safe and well-known underlying.

Can you guide us through the model steps?

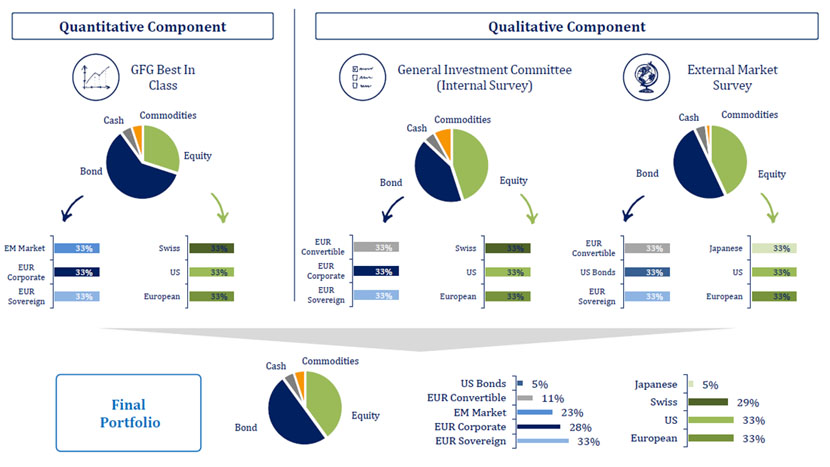

The monthly asset allocation defines the portfolio weights for each Asset Class included in the model (Bonds, Equity and Commodities) and for each one of the 16 market segments defined (European Equity, US Equity, EUR Corporate Bond, US High Yield…). The Asset Allocation is based on three different inputs: a quantitative one based on mathematical analysis of past performances of each Asset Class and market segment; a second one, delivered by GFG’s General Investment Committee, that gathers the views of several Portfolio/Fund Manager working for the company; and lastly, a third one which is the result of an External Market Survey/Research, aimed to provide an independent and general market view.

The combination of strong quantitative tools, backward looking, with qualitative extensive views, forward looking and therefore able to anticipate the impacts and consequences of upcoming Central Banks speeches, elections and data publications, delivers a balanced and efficient Asset Allocation.

How do you select the underlying funds?

GFG LAB developed a proprietary screening methodology, that is run twice a year, based on a database of more than 3000 UCITS funds with daily liquidity. With a multi-parametric score that takes into account several risk-return indicators, the model highlights a short list of suitable funds. The last step in the process involves contacting the AM houses to investigate their strategy and risk management profile.

The whole process is fully independent, enabling GFG LAB to pick the best players for each market segment, without any constraints on specific AMs products. The last selection included 27 different AMs for 32 funds.

Do you plan to expand the scope of the model?

We are currently working on a more sophisticated strategy investing just in UCITS alternative funds. We will select the best products relying on the persistency of Alpha generation. The funds will initially be divided in peer groups with a clustering methodology with a focus on returns and volatility, regardless of the “self-classification” of each product.

We just completed an initial successful roadshow in Italy presenting the first results and we plan to go live with products based on this strategy after the summer.

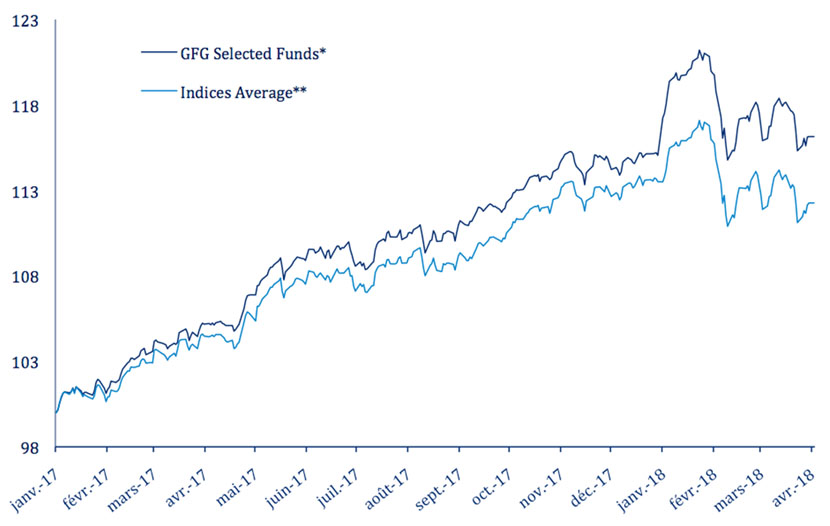

Figure 1 -GFG believes in the ability of the fund managers to outperform the market indices, preferring a basket of funds independently selected to a futures or ETF portfolio. In the chart a representation of the live average performance of the funds selected for the AAA Model versus the average performance of their reference indices.

* Average performance of all the funds picked (Bond & Equity)

** Average performance of all the market indices (Bond & Equity)

Figure 2 - On a monthly basis, each one of the three inputs considered defines an asset allocation. The final portfolio consists in a sophisticated weighting scheme of these three allocations.